Sommeliers Choice Awards 2025 Winners

9 Points to consider as an approach to the Indian Wine Market

India offered to cut customs duties on wines and spirits. This is the right time enter the Indian Market or at least plan for it.

The early bird catches the worm

India offered to cut customs duties on wines and spirits from the European Union to 40 per cent from the present 150 per cent, at the Organization for Economic Co-operation and Development summit in Paris. Attention Liquor, Beer and Wine Companies! This is an excellent moment to enter the Indian Market.

The offer was huge, compared to India's earlier proposal to cut the Customs duty to 80 per cent. It would mean up to a 73-percentage-point cut in India's Customs duty. India also proposed to cut the entry price per bottle of wine to $3.70 and whisky to $5.50.

India and the EU have been discussing this issue which is part of the Fair Trade Agreement since 2007. At present, states set their own tariffs, which apply to domestic wine shipments from other states as well as foreign imports.

This level can vary between 30% and 100%, representing just one of many variables in the country’s notoriously complex and punitive approach to wine taxation.

And even if customs duties are dropped in the future, there’s no guarantee that tipplers in Maharashtra will benefit as the state government routinely increases excise duties on alcohol. For instance, this year the state increased duties on Indian Made Foreign Liquor by 25 per cent and those on strong beer by 43 per cent.

“What we need is a uniform taxation policy, for each time the centre reduces customs duty, the states increase their (excise) component,” said wine consultant and sommelier Magandeep Singh via email. “As a result, wines have been getting more expensive. And then institutions and retail should be given a cap at which they can price products.”

However, the EU is bargaining for concessions. According to senior officials involved in the talks, the Europeans want the duties for wines and spirits reduced further to 30 per cent and the prices of a bottle of wine and whisky to $3.5. "This is the best we could offer at this time. It is a make-or-break situation now.

We have told them clearly what it is and we cannot go below this. We have to follow the TERC (Trade and Economic Relations Committee) mandate," a senior commerce department official told the Business Standard. Apparently, during the last ministerial meeting that took place on May 14, the EU had handed over a letter from its agriculture commissioner Dacian Ciolos to Sharma, asking him to reduce the Customs duty to 30 per cent and maintain the same price point for both wine and whisky at $3.5 a bottle.

9 Points to consider as an approach to the Indian market

1.Survey potential opportunities for the wines in the market. The Office of Agricultural

Affairs can assist new exporters in identifying market research firms who can do this

survey.

2.Recognize that India is large and diverse with varying state policies; consider whether you

wish to enter the market by focusing on a particular city or region before expanding

nationally.

3.Consider whether you are willing to provide promotional funding to your distributor for

your wines.

4.Consider participating in a local food or drink show. Trade show samples are subject to the

same requirements as imported wines and must be imported by someone who holds an

import license.

5.Examine all prospective distributors, and thoroughly research the promising ones through

local industry and trade associations or a market research firm.

6.Identify importers/agents with an established marketing network among the

hotels/restaurants and retailers in various states.

7.Recognize that distributors with fewer suppliers may be more adaptable and committed than

larger distributors with multiple brands.

8.Review the other wines carried by a distributor to avoid potential conflicts of interest with

other companies and countries.

9.Ensuring payment is another important consideration when establishing a relationship with

an importer. Until a successful working relationship is established, exporters may wish to

consider vehicles such as an irrevocable letter of credit. Alternatively, Indian importers are

Wine importers would be overjoyed if customs duties are eventually lowered. But not the local wine industry, says the Business Standard report. It quotes Subhash Arora, president of the Delhi-based consultancy firm Indian Wine Academy, “a reduction of duties to 40 per cent across the board means opening the gate for cheap imports. This way the Indian wine industry will perish and this will also impact the farming community. If this happens, prices will come down so much that nobody will then opt for Indian wines anymore.” Kapil Sekhri, one of the promoters of Fratelli Wines, believes that while a cut on import duties will generate healthy competition in the industry, it should go hand in hand with a reduction of duties on items that local wine makers have to import. “We’re all for the best value for the customer so a cut helps”.

But we would also like a cut on raw materials that we import like bottles and corks.” His other caveat is that hotels that have a duty free quota, which allows them to import various items including alcohol, should be allowed to purchase Indian wines without paying duty too.

Jagdish Holkar, chairman of the Indian Grape Processing Board, told the Times of India “the lack of uniform duty and tax structure is one of the major challenges the wine industry in the country is facing today.”

Given the complexity of the domestic excise, licensing and distribution policies, the key to accessing the Indian market is identifying an experienced importer and distributor. There are only a few people in India who understand the complexities of wine distribution and a prospective importer should have staff with experience in this area. A key consideration for an

exporter is understanding how their wines will eventually be priced for sale after all taxes and fees have been incurred, whether their wines will be sold via retail or the hospitality sector and how widely their wines will be distributed.

Estimates of the number of wine importers have varied from 50 to 80 over the past few years. A number of wine enthusiasts reportedly jumped into the business as imports were rising a few years ago, but some did not have distribution experience and transactions ultimately failed with volumes of unsold wine stranded in warehouses in some cases. The five largest importers account for an estimated 60-70 percent of imports, with the balance of active importers, perhaps 30 firms, each handling less than 10,000 cases per year. A number of importers began as distributors of alcoholic beverages other than wine and have added wine to their portfolios.

Additionally, some Indian wine producers, in an effort to offer a full range of wine options to their customers, are importing wines that complement their domestic wine production.

The Indian wine market has garnered considerable attention over the past few years with many touting the rapid growth and imminent expansion of the market. Indian importers indicate that they receive a steady stream of inquiries from foreign exporters with interest in the Indian market. Many of the established importers already carry U.S. wines within their portfolios and prefer not to carry duplicate types of wine from the same country or state. Wineries from new regions or with new varieties may find greater interest among importers. If imports continue to grow, importers may begin to seek new brands.

Although this beverage is one of the highest taxed products in India because it is considered a luxury not a necessity, Indian Wine consumption has grown 25-30% annually over a 5 year period.

Mahatma Gandhi and Dr. Bhimaro Ambedkar, two leaders in drafting of the Indian Constitution believed that it was the responsibility of the states to regulate alcohol.

In keeping with that, Article 47 mentions that, “The State shall regard the raising of the level of nutrition and the standard of living of its people and the improvement of public health as among its primary duties and, in particular, the state shall endeavor to bring about prohibition of the consumption except for medicinal purpose of intoxicating drinks and of drugs which are injurious to health”.

Wine has traditionally been considered a type of liquor whereby the government morally obligates itself to protect Indian citizens from its misuse. Methods of alcohol control include: serving alcohol only at specific outlets or during specific hours, prohibiting alcohol in religious places, educational institutions and to underage drinkers. The official age of legal alcohol consumption is established at 25 years old. Most Indian states, however, have not prohibited alcohol and some facilitate wine grape growing and wineries.

The median age of current day India is about 25 years old; this demonstrates the fact that half of the Indian population is under 10 years old. In the coming years, 10 percent of the current population will become of legal drinking age, and this will further bring about an increase in alcohol consumption.

The wine industry must also consider the male demographic when marketing their products. Men and not women, typically shop for liquor because restrictions prohibit the sale of alcohol in supermarkets or other convenient locations. Indian women are beginning to prefer wine as a more socially acceptable form of drinking for females. It is seen as more feminine to consume wine as opposed to the hard liquor that men are more traditionally seen consuming. Wine has a softer tone and connotation which is more acceptable to consume in public.

As far as the palate goes, the Indian population prefers table wines. Champagne or sparkling wines sell much lesser than wines. In general, slightly sweet wines and the varietals of Sauvignon Blanc and Chenin Blanc are fairly popular and also pair well with typical Indian dishes. Similarly Rose and Blush have been projected as good fits for the Indian market.

However, the majority of sales have stayed on traditional red and white wines. In regards to presentation, wine producers have two different demographics in the Indian market upon which to focus - the upper class and the general consumer. While the upper class prefers the classic presentation (real cork, full bottle size, and dry red and white wines), the growing middle class in India gravitates towards approachable wine packaging (screw caps, half bottle sizes and sweet wines).

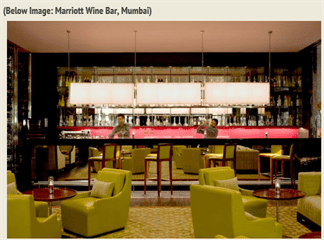

An estimated 50 percent of wine is sold through restaurants, bars, hotels and pubs.

Hotels ranked at three stars and above and some restaurants have the ability to acquire wine (and other products ranging from equipment to food) free of federal tariffs (hotels are still subject to excise taxes and other local fees) based on the amount of their hard currency earnings.

The number of four and five star rated hotels is rising and travel for both tourism and business is robust.

Unfortunately, hotels do not typically pass the savings (from not paying the federal tariff) on to consumers because they use the margins to cover the high cost of obtaining and maintaining alcohol licenses.

If hotels were able to pass these tariff savings on, they could serve as a gateway to introducing consumers to quality affordable wines.

Hotels typically rely on local importers and distributors for their supplies, but will occasionally make recommendations to importers based on direct contact with wineries or import directly. Hotels tend to operate on annual contracts with specific suppliers and some have centralized procurement operations. Only a few hotel chains have sommeliers. There are a few local wine academies that provide training to hotel staff and others interested in learning more about wine.

Retail accounts for the bulk of the balance of wine sales. Traditionally, wine has been sold through thousands of small wine shopsâ which are essentially liquor stores carrying a range of alcoholic beverages.

These stores rarely have air conditioning and do not market wine or other beverages beyond carrying signage or other promotional materials. Additionally, acquiring a retail license can be difficult and expensive, which limits the opportunity to open new stores thereby restricting growth in the retail sales channel.

Some states and cities (Maharashtra, Goa, Haryana, Karnataka, and Delhi) have allowed the sale of wine in supermarkets. India‘s modern retail food industry is beginning to develop and could serve as a new outlet for exposing consumers to wine.

Most modern retailers rely on subcontractors who hold liquor licenses to operate their wine shops. A few wineries and importers have developed programs to sell directly to consumers through wine of the month clubs, subscription services or the internet.

Indian importers indicate that they receive a steady stream of inquiries from foreign exporters with interest in the Indian market. Many of the established importers already carry U.S. wines within their portfolios and prefer not to carry duplicate types of wine from the same country or state. Wineries from new regions or with new varieties may find greater interest among importers.

Recently, India has offered to drastically cut Customs duties on wines and spirits to 40 per cent from the current 150 per cent. The offer made by Commerce and Industry Minister Anand Sharma to EU trade commissioner Karel de Gucht on the sidelines of the Organisation for Economic Co-operation and Development summit in Paris recently was huge, compared to India's earlier proposal to cut the Customs duty to 80 per cent. This would mean up to a 73-percentage-point cut in India's Customs duty. India also proposed to cut the entry price per bottle of wine to $3.70 and whisky to $5.50.

However, the EU is bargaining for concessions and Indian Wine Industry may soon face competition from International brands. According to senior officials involved in talks, Europeans want the duties for wines and spirits reduced further to 30 per cent and the prices of a bottle of wine and whisky to $3.5. This reduction of duties to 40 per cent across the board means opening the gate for cheap imports.

“This way, the Indian wine industry will perish and this will also impact the farming community," said Subhash Arora, President, Indian Wine Academy. He said the government cannot afford to take such a decision at the time of elections. "If this happens, prices will come down so much that nobody will then opt for Indian wines anymore. And even if they are able to sign the treaty on this, the Parliament will not let it pass."

Last year, India had said it would cut the duties to 80-90 per cent to make imported wine and spirits from European countries affordable to Indian consumers.

In summary, we believe that Indian wine consumption has a huge potential. The population growth is estimated at 22 births per 1000 people, equaling almost 25 million births per year; roughly 1/10th of the U.S. population each year. The median age for Indian people is 25 which is also legal age for alcohol consumption, supermarkets are emerging to support wine distribution infrastructure, wine is becoming more acceptable to women and youth, and this country has a domestic market with an increasing disposable income and growing tourism industry.

View a detailed report on Indian Wine Market produced by Office of Agricultural Affairs American Consulate General

Sources:

-Office of Agriculture Affairs, American Consulate General, Mumbai.

-Business Standard

- Indian Wine Academy

-Imagine More