Sommeliers Choice Awards 2025 Winners

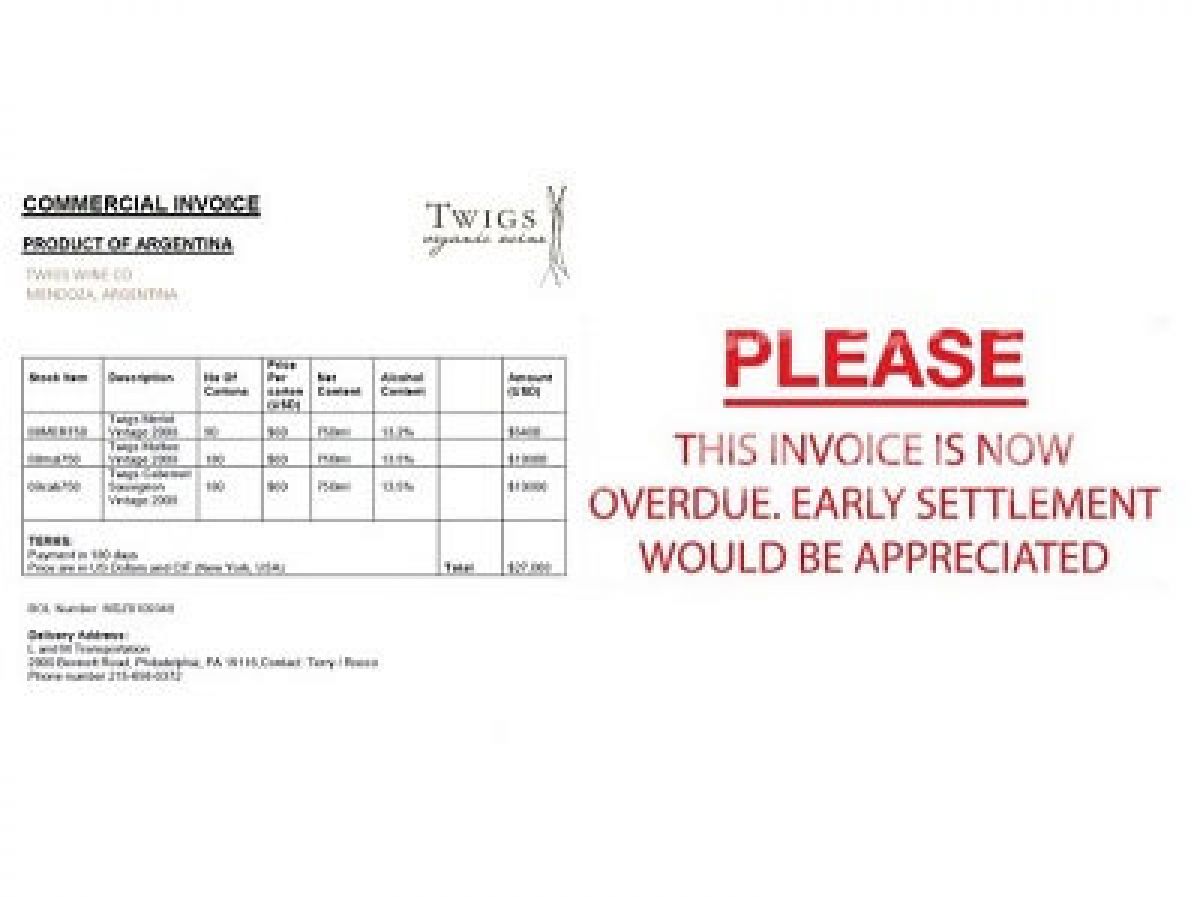

Tips to Get Paid On Time and In Full.

How wineries, breweries and distilleries can reduce the risk of unpaid receivables and maximize their chances at collecting on overdue invoices.

Suppliers in the adult beverage business often take the risk of not getting paid in exchange for the security and benefit of the contract services of a distribution company. Unfortunately for suppliers servicing distributors in the US, the majority of deals are done on a 'promise to pay' basis and suppliers are almost always dependent on their buyer’s ability to pay. Most agreements can develop into long standing partnerships if both parties uphold their terms of the contract, but there are always some that end from unfulfilled promises and unpaid receivables.

Hiring collection agencies and lawyers to collect on unpaid invoices is always complicated and a lengthy headache that everyone should try to avoid by doing their due diligence when selecting distribution partners, developing enduring relationships with the accounts payable department of their buyers and maintaining high business standards across all accounts.

BTN Premium Content

BTN Premium Members, please Log In to access the complete Webinar.

Not a member? Please Sign Up now and choose your Premium plan.

BTN membership gives you full access to articles and webinars on BTN + other benefits like:

- Full Access to BTN Consultants

- Full Access to Buying Leads

- Post Unlimited Brands

- Full Access to all Articles and Webinars

- Full Access to BTN Live conferences presentations and speaker sessions

- Discounted rates to exhibit at major partner events and conferences

- And Much More...

Your BTN Membership will reduce your trial and error time: Why experiment with your branding and distribution when you can fast-track your time to success? Get 'How to do it' content which will help you improve your sales and grow your distribution. Just one article can help you make better decisions and improve your distribution strategy. View Plans Now