Sommeliers Choice Awards 2025 Winners

Around the World at WineParis 2025

Exploring Global Trends and Innovations in the Wine Industry

The halls at WineParis 2025 were decked and with the best kind of decoration there could be -- visitors, of which there were many. As I walked the halls, there were visitors to be found at every pavilion, and almost every booth, with some even hanging on way past 5 pm. There was a noticeable energy around the show coming from not only the quantity but also the quality of the buyers, as confirmed by heads of associations from several regions.

Low and No Alcohol Wines

The IWSR recently stated an expected growth of $4bn from the no alcohol category by 2028. I was curious to see this in action. There was certainly noted interest there, many tastings were happening at the low and no-alcohol wine booths in Hall 5. Buyers were genuinely interested in tasting these products.

When discussing low and no-alcohol wines, Steffen Schindler, Director of Marketing for Wines of Germany, mentioned that Germany was one of the first countries to start making non-alcoholic wines in 1907. Today, Germany has many facilities that offer services to de-alcoholize wines. He mentioned that “One of the producers from Germany has received an order for non-alcoholic wines that exceeded his annual sales for his regular wines." This is a testament to the fact that low and no-alcoholic wines are not going anywhere, the demand for them is on a steady rise.

Image: Malvika Patel with Steffen Schindler, Director of Marketing for Wines of Germany

Laura Jewell MW from Wine Australia mentioned that Australian low and non-alcoholic wines are leading the way in the UK market and were a topical point for the fair.

Image: Wine Australia.

When I began comparing non-alcoholic wines that I tasted at the fair to their alcoholic counterparts (could do with more texture, less residual sugar), Steffen mentioned (as have other winemakers before), that we need to stop comparing no and low-alcoholic wines to alcoholic wines as they will never taste or feel the same. I would like for a marketing genius to come up with a brand new name for this category so that it doesn't spend years justifying itself alongside ‘real’ wine.

Emerging and Exciting Regions

It was impressive to see the turnout from regions like the Wines of Great Britain, Washington State, NY Wines, Swiss Wines, and Moldova. It is not that these regions are new at producing wine, but that they arrived with a sizeable representation to take on the European market. These regions produce some excellent quality wines, and it is now time for them to tell their story.

Image: Malvika Patel with Nicola Bates, CEO of Wines of GB.

Wines of GB for the first time have seen such tremendous growth in their production with climate change being a contributing factor. They are now primed for exports. The team led by Nicola Bates is tasked with charting an export strategy in major markets and capitalising on the current thirst for English wines. English wine is also now going beyond sparkling to Chardonnays and reds.

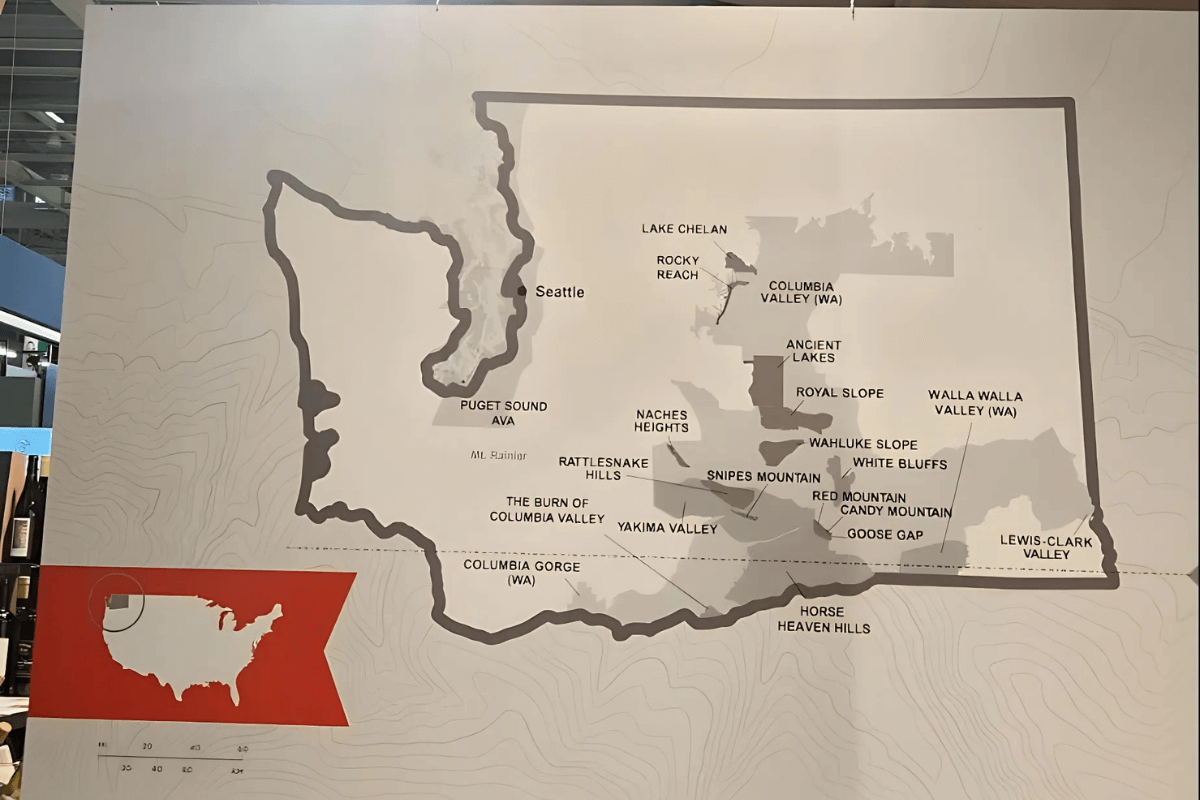

Image: Malvika Patel with Chris Stone, Deputy Director, Washington Wines.

Washington Wines - a region that offers impressive wines remains committed to the UK market, a market that has long been an established ground for many European winemakers. Washinton Wine's current focus is to educate the trade and get their story out. They would like to demonstrate the quality that they can offer and make a place in the minds of sommeliers and consumers alike when they think of a great bottle of wine. They are focusing on by-the-glass pour as an introduction to the region. This gives the consumer a chance to try their wine and make a place in their minds about Washington Wines.

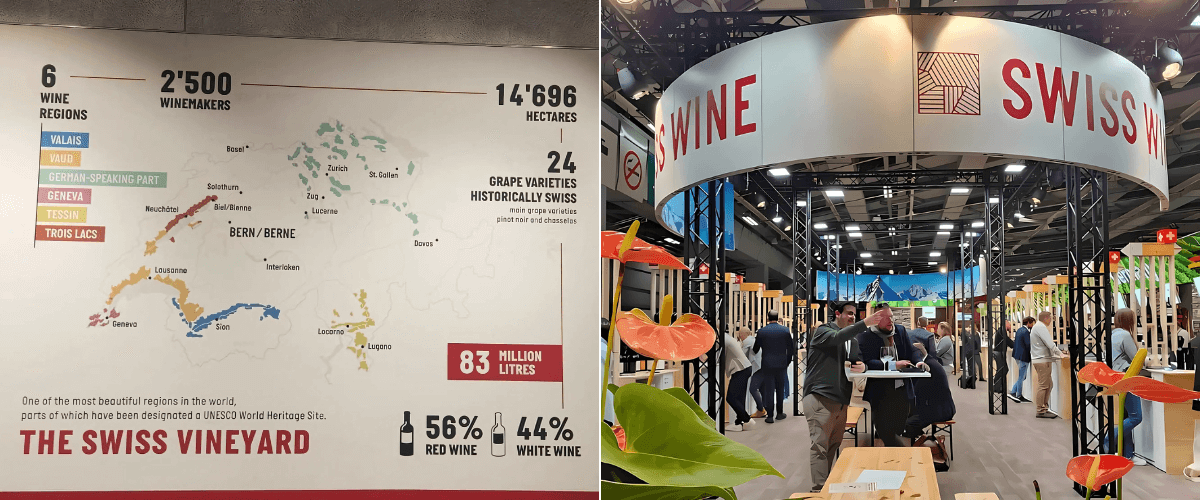

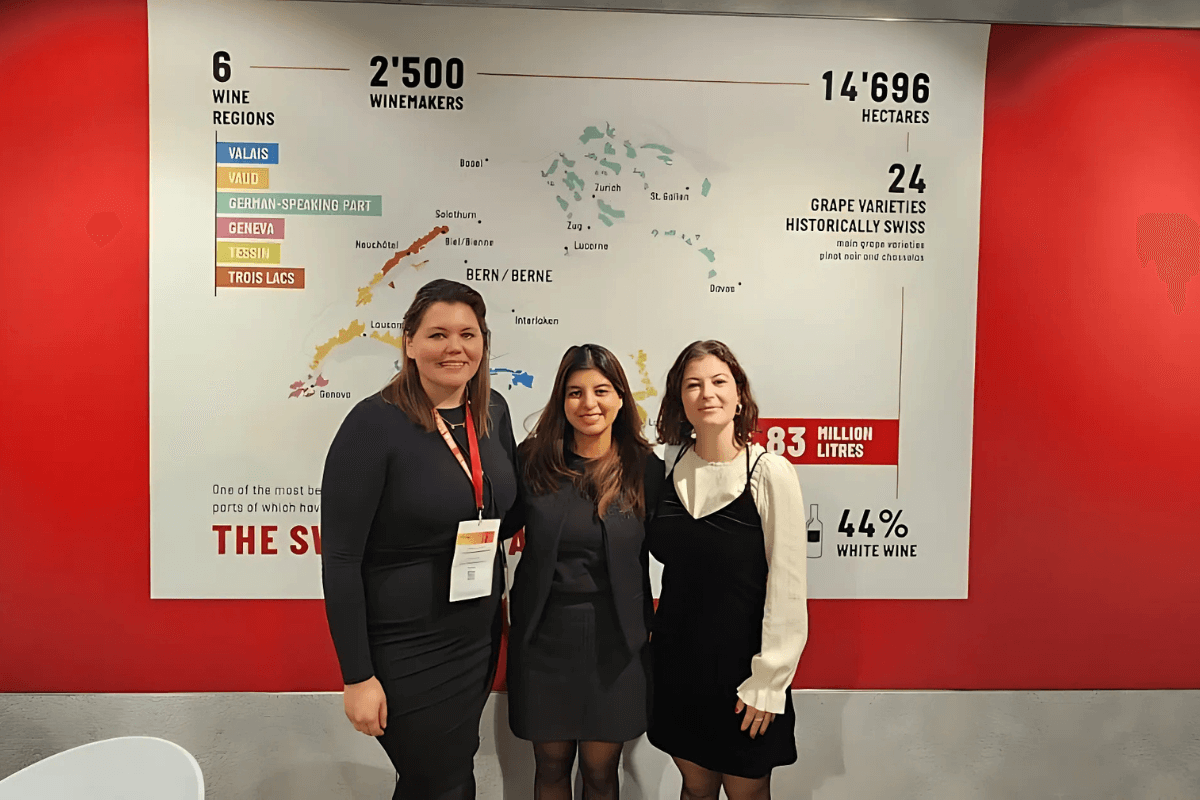

Image: Swiss Wines

Swiss Wines is focused on bringing their best wines to the table for export markets. As tourism has always been a strong point for the country, they are now offering tourists a taste of their fantastic wines served with the stories of winemakers.

Image: Wines of Moldova - Sid & Malvika with Ionela Stati, Senior Specialist. Responsible for international market development and B2B programs for Wines of Moldova.

Wines of Moldova, a relatively unknown figure in the US and UK markets compared to most other regions are shying away from the bigger markets and making their way into newer areas where they don't have to knock their way through other well-established wine giants. Asian countries are high on their focus at the moment.

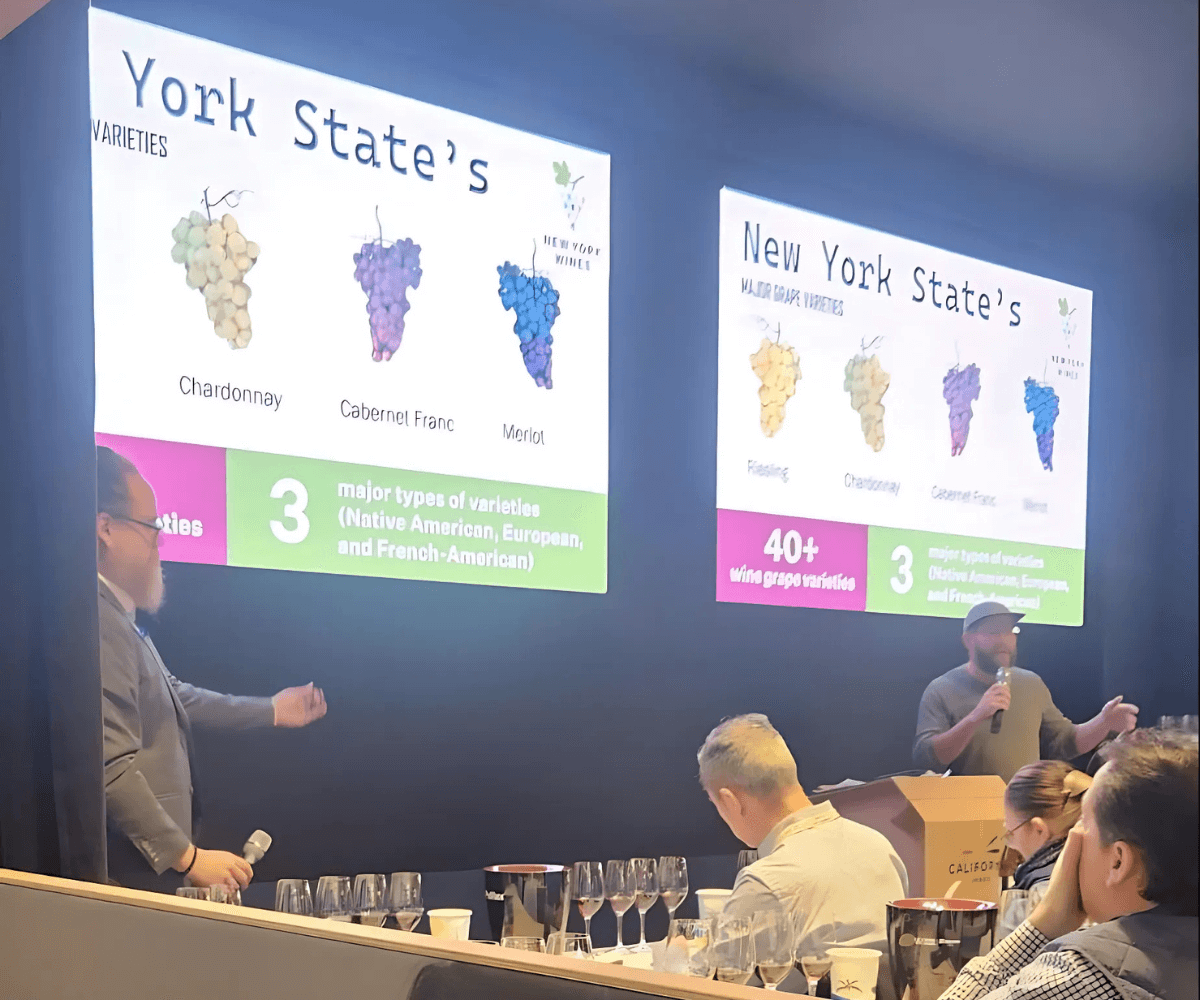

Image: NY Wines Masterclass in progress.

NY Wine producers were represented along with ambassador Dan Belmont. A challenge for other wine-growing regions in the US like NY Wines is for the trade and consumers to think of them aside from California. The association is working toward this with continued tastings in the UK and media partnerships to tell their story.

Old World Wines

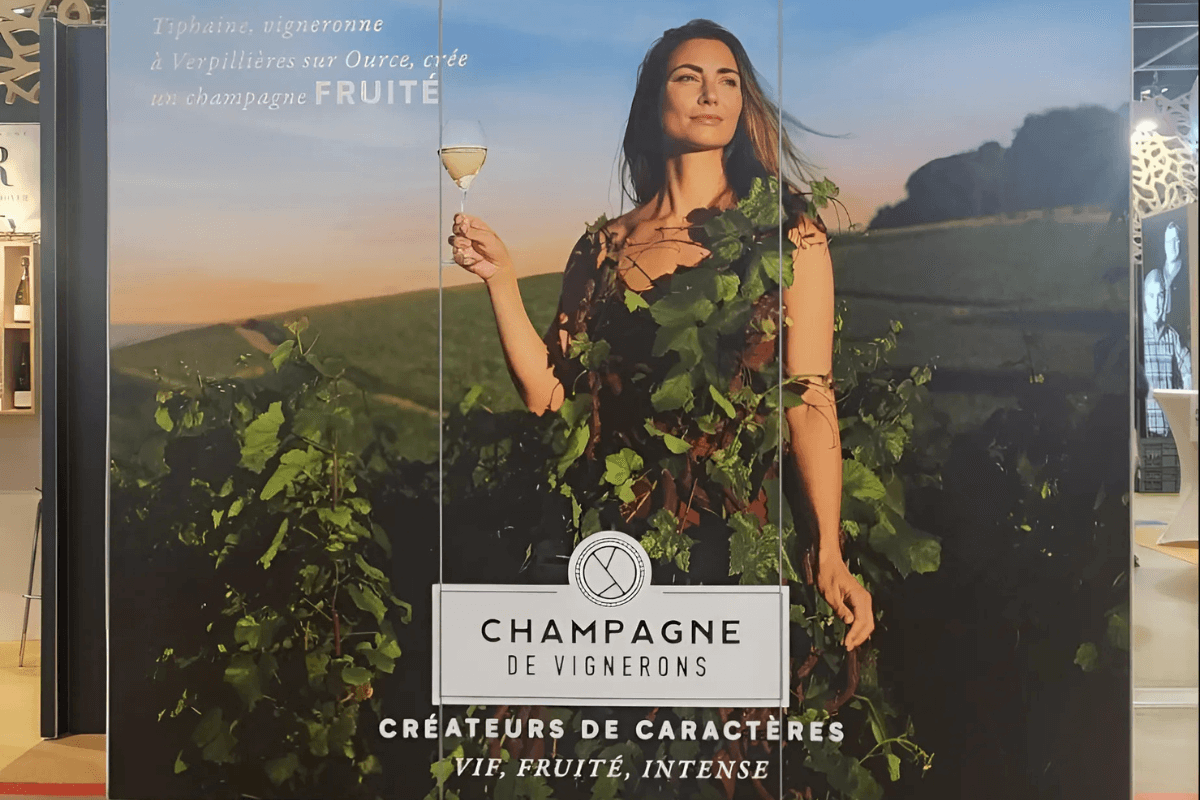

Champagne may have been down by 9% in 2024 but Maxime Toubart, President de la Syndicat Général des Vignerons, is confident that they can ride the wave out.

Left Image: 300 Champagne des Vignerons growers exhibiting at WineParis 2025. Right Image: Malvika Patel with Maxime Toubart, President de la Syndicat Général des Vignerons.

Maxime mentioned, “Last year we sold 80% of Champagne to six countries. It is important for us to sell to newer markets like South Africa and South American countries like Brazil where we are seeing increasing demand.“ He puts down the current slump to the world atmosphere we are living in, wars, inflation, geopolitical tensions in France, and impending duty hikes from the US. He says, “Champagne is synonymous with celebration. People drink Champagne when they are happy when they want to want to invite people over, and there has not been much to celebrate lately.” Maxime sees a lot of opportunity in newer markets and in creating new occasions to drink Champagne. Let's hope 2025 holds a brighter spot for Champagne houses.

The pavilion at Chianti Classico was also abuzz with visitors, with Silvia Florentini, Marketing Communications Manager pleased with the buyer turnout.

Left Image: Wines of Rousillon. Right Image: Malvika Patel with Eric Aracil, Directeur adjoint et responsable export, Conseil Interprofessionnel Des Vins Du Roussillon.

Eric Aracil, Directeur adjoint et responsable export, Conseil Interprofessionnel Des Vins Du Roussillon had many a masterclass scheduled, with every session being well-attended.

Sustainability

I wanted to know how far sustainability is going in the real world. Are consumers asking for sustainable wines?

Most associations mentioned that consumers from Nordic regions are the majority of consumers asking for sustainable wines. They are also quite stringent about their requirements for wines that qualify as sustainable.

Image: Washington State Wines

Chris Stone, Deputy Director of Washington Wines mentioned that “younger consumers are interested in knowing where their products and wine comes from”. The region itself is geared toward sustainability, in their produce and in their wine. The consumer ask is not the driving factor toward their commitment to sustainability but rather them being committed to becoming more sustainable. More and more wineries are qualifying for their program SWA - Sustainable Washington, a logo that is proudly displayed at the back of their bottles. “One-third of the state’s vineyard acreage is already certified by a third party, it’s a very rigorous program.”

Image: With Océane Gex and Fiona Vaucher, Swiss Wine.

Océane Gex from Swiss Wines Promotion mentioned that “consumers today are concerned about many other factors today like inflation so sustainability has fallen lower on their radar,” but the winemakers in Switzerland are still marching forward. She mentioned that “20% of Swiss vineyards are certified organic.” The minimum salary in Switzerland ensures that winegrowers and their employees are paid fairly, ticking off another important sustainability requirement.

Sustainability is also an important focus for Champagne, mentioned Maxime Toubart, President de la Syndicat Général des Vignerons where 60% of vineyards in the appellation have secured environmental certification, VDC certification in more than 40% of cases.

Steffen Schindler from Wines of Germany mentioned one of the larger sustainability organizations Fair’N Green that works with wineries to offer them a new goal every year to become more and more sustainable, it is more of an ongoing effort.

To encourage more wineries to begin their journey toward sustainability, Nicola Bates, CEO of Wine GB, mentioned that there are many free resources for wineries to take advantage of. They offer wineries toolkits that they could utilize on their journey towards sustainability even if they are not seeking accreditation straight away.

In Other News

Image: With Julie Hesketh-Laird, CEO of FIVS

Julie Hesketh-Laird of the FIVS mentioned that she had a fruitful few days at WineParis meeting with stakeholders and producer members of the organization to know and understand their perspectives.

I asked Jamie Ritchie of Blockbar about how the rare and collectible market is faring and he mentioned that Asia is not at a pre-Covid level but he is placing his bets on the US market where he sees a more stable landscape right now.

Honore Comfort shared her views on “Reaching Zillennial consumers: new rules of engagement,” a topic that aligns with Beverage Trade Network’s new initiative Let's Grow Wine, bringing together wine marketers and associations to talk about ways to reach the new consumer and take effective actions to grow the wine category again.

Prowein or WineParis

There was an unavoidable undercurrent of conversation on this topic in 2024 and has been this year as well.

Image: With Magdalena Pesce, CEO of Wines of Argentina

Magdalena Pesce, CEO of Wines of Argentina mentioned that their stand at Prowein is shrinking every year, with fewer producers choosing to participate. If this downward trend continues, the association may consider pulling out their generic stand from the show. Rafael Romagna from Wines of Brazil mentioned a similar situation. Wine Australia has already made the decision, choosing not to have a pavilion at Prowein this year.

Left Image: Argentina’s Winegrowing Regions. Right Image: Meetings at the Wines of Argentina Pavilion

WineGB exhibited at WineParis for the first time this year and Nicola Bates, CEO of Wine GB, mentioned that they are quite happy with the buyer turnout.

While most participants cite reasons like lack of direct flight connections to Düsseldorf from international airports, strikes that cause travel havoc almost every year, hiked hotel rates, and the hosting city’s inability to compete with the allure of Paris, and all of these reasons matter, but they don’t take away from the most glaring one - the dwindling number of visitors.

In the current wine economy with shrinking marketing budgets, producers are in a position where they have to choose, and for most, the choice is clear.

Written by Malvika Patel, Editor, Beverage Trade Network.

Also Read:

WineGB’s Roadmap: Cultivating Success Under Nicola Bates

Redefining Argentina’s Wine Identity: Heritage Grapes and Global Aspirations

From Vine to Vision: Insights from the Washington State Wine Commission