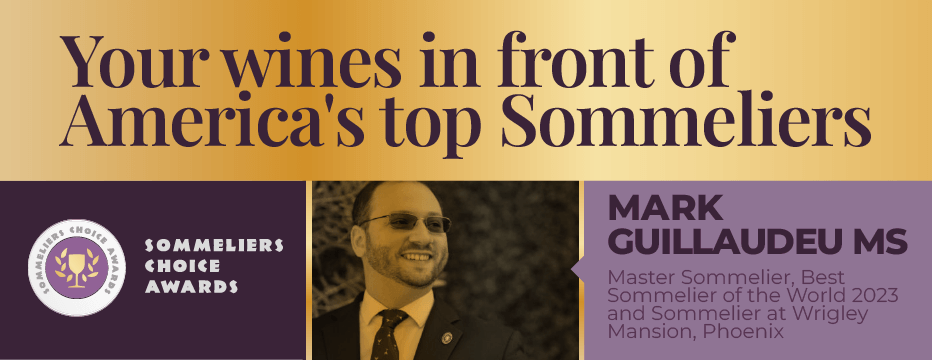

Sommeliers Choice Awards 2023 Winners

Anheuser-Busch InBev Response to SABMiller Announcement

AB InBev continues to say that this proposal "still very substantially undervalues SABMiller".

BRUSSELS, Oct. 8, 2015 /PRNewswire/ -- Anheuser-Busch InBev ("AB InBev") (Euronext: ABI) (NYSE: BUD) notes the announcement from the Board of SABMiller plc ("SABMiller") (LSE: SAB) (JSE: SAB) rejecting AB InBev`s proposal of GBP 42.15 per share in cash, with a partial share alternative.

AB InBev is surprised that the Board of SABMiller (excluding the directors nominated by SABMiller`s largest shareholder, Altria Group, Inc., who dissented) continues to say that this proposal "still very substantially undervalues SABMiller".

This lacks credibility because:

- The cash proposal represents a premium of approximately 44% to SABMiller`s closing share price of GBP 29.34 on 14th September 2015 (being the last business day prior to renewed speculation of an approach from AB InBev); and

- Altria Group, Inc., which owns 27% of SABMiller and has three representatives on the Board, has publicly stated that it supports our proposal and "urges SABMiller`s board to engage promptly and constructively with AB InBev to agree on the terms of a recommended offer".

The Board of SABMiller has also referred to the highly conditional nature of the proposals, including significant regulatory hurdles in the US and China, "on which AB InBev has not yet provided comfort to SABMiller". Together with its advisers, AB InBev has done significant work on regulatory matters and has identified solutions that provide a clear path to closing. AB InBev intends to work proactively with regulators to resolve any concerns. AB InBev has repeatedly offered to share this analysis with SABMiller and its advisers. Each time the Board of SABMiller has refused to engage.

Read More at Source | PR Newswire