Sommeliers Choice Awards 2025 Winners

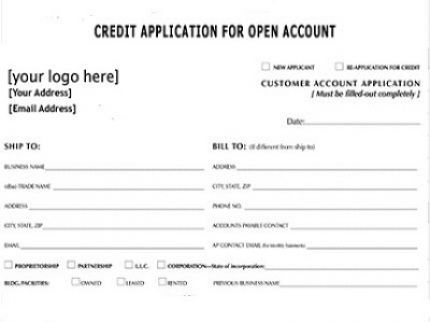

Credit Application Forms

Tips on Designing Credit Application Forms

In the excitement of getting a new customer, it’s easy to jump straight in and start trading with them without thinking too hard about whether they are a good credit risk or not. But remember - “It doesn’t count until it’s in the account”. A sale won is worthless if the customer never pays for your goods or services and you have to write it off as a bad debt.

Having a robust process to assess whether a customer is creditworthy and to decide how much credit to extend is an essential part of a well run credit control function and could save you a great deal of money in the long run.

Before lending your money to a company, send them a credit application form to complete.

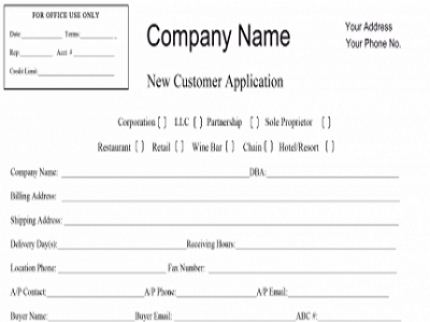

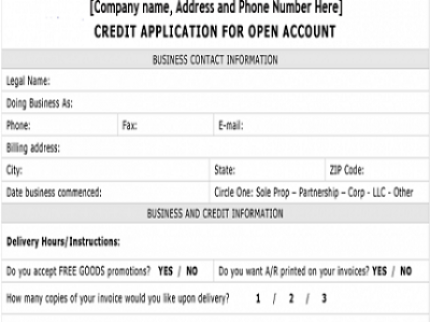

If you are dealing with a new customer who wants to establish a line of credit then it is vital that you begin the credit management process at the earliest possible date. Ask for the basic information that you will need in order to assess whether the risk you are taking in providing them with credit is commercially viable.

At Account opening stage the business has three objectives:

1. To establish the correct identity of the customer.

2. To confirm that customer's ability to pay.

3. To agree Trading Terms.

These objectives are not difficult to achieve. A simple Credit Account Application Form can be used to obtain information, and to set out, on the reverse, the supplier's Terms of Trading. By signing the completed Form, the customer provides the information and agrees the Terms