Sommeliers Choice Awards 2025 Winners

Forging Unity: How DF-SA Is Transforming South Africa’s Alcohol Industry

A unified voice for South Africa’s alcohol industry under Angela Russell’s leadership.

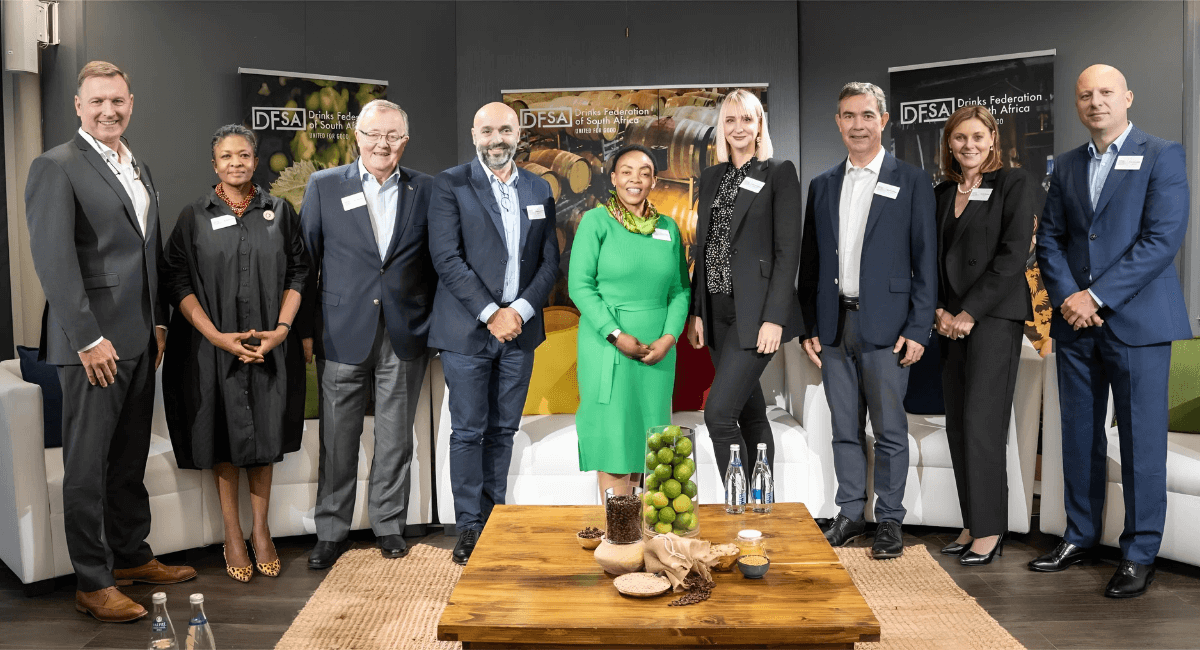

Under the leadership of CEO Angela Russell, the Drinks Federation of South Africa (DF-SA) is successfully unifying a diverse industry that spans global producers and local independents in beer, wine, cider, and spirits. Alongside key leadership members, including founding members from Diageo, Pernod Ricard, Heineken, DGB, and South African Breweries, Angela is steering DF-SA through critical challenges, focusing on fostering collaboration, promoting responsible drinking, and enhancing the industry's contributions to society. The COVID-19 pandemic highlighted the urgent need for a coordinated response, and Angela’s leadership is playing a pivotal role in navigating these challenges while emphasizing the collective responsibility of the industry to support South African communities. Today, DF-SA stands as the authoritative voice of the alcohol industry in South Africa, tackling issues such as illicit trade, public health concerns, and the need for sustainable growth.

Angela, under your leadership, how has the Drinks Federation of South Africa (DF-SA) unified such a diverse industry? What were some key challenges in bringing stakeholders together under a shared vision, and how have you navigated these challenges?

The Drinks Federation of South Africa (DF-SA) has successfully unified a diverse industry composed of global and independent producers of beer, wine, cider, and spirits. The formation of DF-SA was driven by the collective desire of these producers to establish a new industry body that would represent a unified voice for the alcohol industry in South Africa.

The COVID-19 pandemic highlighted the urgency of this unity, as the nationwide ban on domestic and export sales, as well as the production and transportation of alcohol products, underscored the importance of a coordinated response. The crisis made it clear that the sustainability and prosperity of the industry were intrinsically linked to the well-being of South African communities.

We have a shared vision that emphasizes the mutual benefits of collaboration. The DF-SA brought stakeholders together around the common goal of becoming an industry that is valued not just for its economic contributions—such as job creation and GDP growth—but also for its commitment to social responsibility. We have worked to build consensus by focusing on shared values, such as promoting responsible drinking behaviours and contributing to a safer and more prosperous South Africa.

Through open dialogue, transparency, and a commitment to collective action, DF-SA has managed to unite the industry behind our vision: to be recognised for the breadth and depth of our contributions to society. By emphasising that the industry's prosperity coincides with the prosperity of the communities we serve, we have cultivated a sense of shared purpose that transcends individual business interests. This collaborative approach will be key in driving DF-SA’s mission forward.

Bringing the stakeholders together did not present any real challenges. Rather, the challenges experienced were linked to some of the red tape around starting up a new organization and operational scale-up.

Image: (From L-R) Gavin Pike, MD Diageo South Africa; Monhla Hlahla, DF-SA Non-Executive Chairperson; Tim Hutchinson, Chairman of DGB; Gregory Leymarie; CEO of Pernod Ricard South Africa; DM Pinky Kekana; Karin Krause Wessels, MD of Edward Snell & Co; Wim Buhrmann, MD of Distell; Angela Russell, CEO of DF-SA; and Jordi Borrut Bel, MD, Heineken South Africa. Members not in the picture: Boris Rivett-Carnac, CEO of South African Breweries, and Boyce Lloyd, CEO of KWV

Credible scientific research is one of DF-SA's pillars. How is the organization using data and research to inform its programs, particularly in understanding alcohol consumption patterns and addressing public health concerns? What research findings have been most impactful so far?

The DF-SA places a strong emphasis on credible scientific research as a foundation for our discussions and programs, and we are currently in the data-gathering phase with five research projects commissioned this year. Our goal is to ensure that all decisions are based on sound, credible research that helps us understand the industry's impact on society and address public health concerns effectively.

Economic Impact Study: We recently conducted an economic study to assess the collective impact of the alcohol industry on the South African economy. The findings reveal that our industry is a net positive contributor, accounting for 3.6% of the GDP, contributing 6.7% to the government’s tax revenue, and employing close to 500,000 people across the value chain. These insights underscore the economic importance of the industry and help us align with national economic priorities.

National Prevalence Study on Alcohol Consumption Patterns: We have commissioned a national prevalence study to gather current data on alcohol consumption patterns among people of legal drinking age in South Africa. This research aims to profile different drinker types, determine the prevalence of alcohol use dependency, and provide a comprehensive understanding of the country's relationship with alcohol. The insights from this study will guide our efforts to promote responsible and mindful alcohol consumption and help us tailor interventions to specific population sets and geographic regions.

Study on Drivers of Binge Drinking: To address binge drinking, we are conducting a study to identify its underlying drivers in South Africa. This will provide us with valuable insights into this behavioural trend and enable us to evaluate the effectiveness of our current programs and refine our intervention strategies to better target and mitigate this harmful behaviour.

Research on Underage Drinking: Recognizing the societal concern surrounding underage drinking, we have initiated a research project to explore the prevalence and root causes of this behaviour in South Africa. This study will provide critical insights that will inform our interventions aimed at reducing underage drinking and its associated risks.

Forensic Analysis of Counterfeit Alcohol: We are also undertaking a forensic analysis of counterfeit alcohol and its physiological effects on consumers. The results will be used to raise public awareness about the dangers of counterfeit products and support regulatory efforts to combat this illicit trade.

Through these research initiatives, DF-SA is committed to using data-driven insights to inform our programs and policies. By understanding alcohol consumption patterns and addressing public health concerns with evidence-based strategies, we aim to contribute positively to societal well-being and promote a culture of responsible drinking in South Africa.

Image: (Left) Dr Shamal Ramesar, Head - Research, DFSA, and (Right) Siyabulela Gebe, Policy & Stakeholder Manager, DFSA.

Stakeholder engagement and collaboration are vital for the DF-SA’s mission. How are you fostering open dialogue with the government and other key players to drive societal progress? What strategic partnerships have been formed, and how are they helping to address the complex challenges the industry faces?

The DF-SA recognises the importance of stakeholder engagement and collaboration as fundamental to driving societal progress and achieving the DF-SA’s mission. To foster open dialogue with the government and other key players, we have implemented the following approaches:

We consult with government agencies, policymakers, and regulatory bodies to discuss industry challenges, opportunities, and the alcohol sector's socio-economic impact. These meetings allow us to provide input on policy formulation and provide the industry's perspectives to be considered in decision-making processes.

We participate in public-private partnerships that focus on addressing societal issues related to alcohol consumption, such as responsible drinking campaigns, underage drinking prevention, and initiatives to reduce alcohol-related harm. By collaborating with various stakeholders, including non-governmental organisations and community groups, we aim to contribute positively to public health and safety.

We also join industry forums and working groups that include key players from across the value chain. These platforms enable us to share best practices, align on industry standards, and collectively address challenges such as illicit trade, responsible marketing, and trade compliance with regulations.

In leading responsibility and education initiatives, DF-SA partners with organizations like Aware.org. Can you share more about the specific programs being developed to reduce harmful drinking behaviors? How do you measure the success of these educational interventions in promoting a healthier drinking culture?

DF-SA partners with Aware.org to lead responsibility and education initiatives aimed at reducing harmful drinking behaviours and promoting a healthier drinking culture in South Africa. Aware.org takes a whole-of-society approach, focusing on key pillars such as preventing underage drinking, eradicating alcohol use during pregnancy, promoting road safety, and encouraging responsible drinking among adults.

The Underage Drinking Prevention programme seeks to eliminate alcohol consumption among individuals under the age of eighteen. It targets youth, parents, and educators to discourage early exposure to alcohol. The program includes educational campaigns in schools, community outreach, and resources for parents and educators to help guide young people toward making informed decisions about alcohol.

Fetal Alcohol Spectrum Disorder (FASD) awareness focuses on preventing alcohol use during pregnancy and raising awareness about the risks of FASD. It primarily targets pregnant women but also involves healthcare professionals, caregivers, partners, families, and the broader community. The program includes educational workshops, support groups, and public awareness campaigns designed to communicate the dangers of alcohol consumption during pregnancy and to provide support to those affected by FASD.

Road Safety initiatives emphasise the dangers of drinking and driving, especially during high-risk periods like holidays and weekends. The program includes public awareness campaigns, partnerships with law enforcement to enhance roadside checks, and initiatives aimed at promoting alternative transportation options for those who have been drinking.

Aware.org employs a combination of quantitative and qualitative methods to evaluate the effectiveness of these educational interventions. Behaviour change surveys assess shifts in attitudes and behaviours towards alcohol consumption among target groups, such as reductions in underage drinking or decreased instances of drinking and driving. Gathering insights directly from communities also helps to gauge the local impact of programs and understand areas for improvement. This feedback loop ensures that initiatives remain relevant and effective in addressing community-specific challenges.

Each program has defined KPIs that track progress towards its specific goals, such as the number of educational sessions conducted, reductions in reported cases of FASD, or the reach and engagement of road safety campaigns. Through these metrics, an assessment of the overall impact of their initiatives can be conducted. Continuous monitoring and evaluation allow for the adjustment and refinement of programs to better meet the needs of South African society, ensuring that the industry’s efforts in promoting a healthier drinking culture are both effective and sustainable.

Image: DFSA joined by partner Aware.org at GIBS Business School (Gordon Institute of Business Science) to tackle the important topic of underage drinking in SA.

Given the country's socio-economic challenges, the domestic landscape of the South African drinks industry is complex. How does DF-SA navigate these challenges while promoting responsible consumption and supporting community well-being?

DF-SA addresses South Africa’s complex socio-economic challenges through a holistic and collaborative approach that involves multiple stakeholders, including the government, private sector, civil society, and other partners. By recognising the deep connections between socio-economic factors and drinking behaviours, DF-SA is committed to conducting research to identify the key challenges influencing alcohol consumption. This research will shape DF-SA’s strategies to promote responsible drinking and inform policy decisions that ensure industry sustainability, job security, and growth in employment opportunities.

The industry demonstrates its commitment to addressing socio-economic issues through extensive Corporate Social Investment programs, with a combined investment of over R520 million. These initiatives include entrepreneurship programs to develop small businesses, support for farmers and Agri-processing, and broader community support in areas where manufacturers operate. From an employment perspective, 86% of the industry’s direct workforce is comprised of individuals from previously disadvantaged backgrounds, highlighting its commitment to economic empowerment and inclusion.

Collaboration with enforcement authorities to reduce the circulation of illicit alcohol is important. This helps decrease crime and enhance community safety. Some manufacturers further support law enforcement by providing additional resources, which aids in curbing irresponsible alcohol trading and related criminal activities while simultaneously creating jobs in those communities.

Through the efforts of Aware.org, the industry prioritises driving behavioural change by reducing underage drinking, promoting sober pregnancies, and minimising incidents of driving under the influence, demonstrating a strong commitment to public health and safety. DF-SA remains dedicated to working with its members and relevant stakeholders to amplify these initiatives, ensuring that the industry takes an active role in addressing the socio-economic challenges facing the nation.

Illicit trade remains a significant issue in the South African drinks industry. Could you share some insights into the initiatives DF-SA is leading to combat this, and how effective these efforts have been in curbing illicit activity?

The illicit alcohol market poses a significant threat to the South African drinks industry, diverting billions of rands from legitimate businesses and government revenues. This underground market expanded notably during the COVID-19 alcohol bans, growing by 10% CAGR between 2017 and 2020 and now representing approximately 22% of the total market in volume. The components of this illicit market include smuggling- both ethanol as a raw material and finished products (31%), counterfeit alcohol (23%), homebrews (24%), and tax leakages (22%).

A concerted effort is needed to disrupt these illegal operations, and it requires a coordinated strategy that goes beyond simple law enforcement. As an industry, we work collaboratively with the South African Police Services as organised criminal syndicates become more sophisticated in their efforts. However, policing and crackdowns must be complemented by policies that address the root cause of illicit trade. Public-private partnerships also play a crucial role in developing innovative solutions to detect and deter illicit activities.

Engagements are held with the South African Revenue Services to discuss excise and pricing policies that inadvertently drive demand for cheaper, illicit alternatives. To tackle the smuggling of illicit alcohol, the industry supports enhanced border controls, particularly along the borders with Mozambique, Swaziland, and Lesotho. Ongoing training is provided to SARS Customs Administration Officials to better identify and intercept illicit products at entry points, thereby assisting in reducing the flow of illegal goods into the country.

To address the issue of illicit products entering the formal market and competing directly with legitimate brands, the industry provides training to distributors, retailers, and other channel members. This training helps them recognise and avoid purchasing illicit products, thus protecting consumers and supporting legitimate businesses in maintaining their market share.

Given the public health risks associated with illicit alcohol—such as counterfeit products containing harmful substances like methanol—the industry also focuses on public awareness campaigns. These initiatives are particularly emphasised during high-risk periods like the festive season, educating consumers on how to identify illicit products and understand the severe health consequences that may arise from their consumption.

While these initiatives have had some success in disrupting illegal operations and raising awareness, the industry recognises the need for further action and policy support to fully curb illicit trade. Key policy recommendations that could enhance these efforts include:

Adjustments to excise taxes could help reduce the price gap between legitimate and illicit products, thereby making legal options more competitive. Increasing penalties for those involved in the illicit alcohol trade could strengthen the deterrent against such activities. Expanding public health campaigns to raise awareness about the dangers of illicit alcohol consumption could further reduce demand for illegal products. Implementing measures to improve transparency in the alcohol supply chain can help trace and eliminate the sources of illicit products. Providing incentives or support programs for legitimate businesses would enhance their ability to compete against illicit players, thereby strengthening the overall market integrity.

These recommendations, in conjunction with ongoing industry initiatives, are vital for creating a robust response to the illicit trade problem in South Africa’s drinks industry. By addressing both the supply and demand sides of illicit trade and promoting cooperation between the public and private sectors, the industry can better protect its economic interests, consumer health, and overall market integrity.

What are the key milestones that DF-SA aims to achieve in the coming years as it continues to develop? How do you see these strategic pillars evolving to address both current and future challenges in the South African drinks industry?

DF-SA has set key milestones that align with its vision of building a drinks industry valued for its contribution to a prosperous, just, and safer South Africa. The organisation’s strategic pillars—credible scientific research, market integrity, stakeholder engagement and collaboration, and responsibility and education—are central to our approach to addressing current and future challenges in the South African drinks industry.

Credible Scientific Research: A core focus of DF-SA is gathering relevant data and insights to inform industry decisions. By supporting credible scientific research, the DF-SA aims to provide a robust evidence base that underpins its advocacy and operational strategies. We will continue to conduct necessary and relevant studies that will be vital in shaping targeted interventions and adjusting strategies to meet emerging challenges, such as shifts in consumer preferences and public health concerns.

Market Integrity: DF-SA aims to implement advertising and marketing self-regulation, promote responsible trade practices, advance market formalisation, and significantly influence the reduction of illicit trade. These initiatives are essential for creating a level playing field and ensuring that the industry operates within a framework of integrity and accountability. As the industry evolves, DF-SA will need to continuously refine its self-regulation standards to keep pace with changing market dynamics and consumer behaviours. Enhancing collaboration with regulatory authorities to crack down on illicit trade will be crucial in protecting the formal market and safeguarding public health.

Stakeholder Engagement and Collaboration: DF-SA seeks to shape balanced policy and regulations through active engagement with stakeholders, including government, communities, and industry players. Creating positive dialogue around the industry’s contributions is also a key goal aimed at enhancing the sector’s reputation and fostering cooperative relationships. This pillar will evolve to focus more on strategic alliances and partnerships, ensuring that the drinks industry has a voice in broader national conversations around economic development, health, and social welfare. As the political landscape shifts, maintaining strong advocacy and a collaborative approach will be critical for navigating policy changes and securing pragmatic regulatory outcomes.

Responsibility and Education: Leading responsible consumption initiatives and promoting responsible trade are pivotal to DF-SA’s mission. This pillar aims to educate consumers and traders alike on the importance of responsible behaviour, thereby reducing the social harms associated with alcohol misuse. The success of these initiatives will be constantly reviewed and adapted to the social context and will leverage digital platforms and innovative communication strategies to reach diverse audiences.

As DF-SA continues to develop, these strategic pillars will evolve to address the most pressing challenges facing the South African drinks industry

Image: DF-SA’s Board of Directors including DGB (Pty) Ltd; Diageo South Africa (Pty) Ltd; Distell Limited; Edward Snell & Company, Heineken South Africa (RF) (Pty) Ltd, Pernod Ricard South Africa (Pty) Ltd, South African Breweries (Pty) Ltd, and Warshay Investments (PTY) trading as KWV.

Looking forward, what are the most pressing challenges the South African drinks industry faces, and how do you envision DF-SA addressing them to ensure the long-term growth of the sector?

The South African drinks industry contributes a net positive R62 billion to the economy, representing 3.6% of the nation’s GDP and accounting for 6.7% of total taxes across the value chain. It also generates employment, provides jobs to around 500,000 people, and supports livelihoods in both urban and rural areas.

The South African drinks industry faces several pressing challenges, including policy uncertainty, inadequate regulatory enforcement, a growing illicit alcohol market, and the need to foster a culture of responsible consumption. In addition, overarching societal issues such as unemployment, poverty, and inequality continue to impact the sector.

The recent formation of the new Government of National Unity (GNU) brings both opportunities and challenges. A key challenge for the GNU is to implement policies that promote economic growth and stability, which will, in turn, boost business confidence and attract foreign direct investment. Through advocacy, we need to engage effectively with the new political decision-makers to promote a stable regulatory and policy environment that will promote industry growth.

We support context-specific regulations for South Africa that address the root causes of alcohol-related harm rather than adopting one-size-fits-all international approaches. South Africa has its unique challenges. The industry is deeply intertwined with broader societal issues. Addressing unemployment, poverty, and inequality is essential not only for the social well-being of the population but also for advancing a culture of responsible drinking. The DF-SA aims to promote a culture of responsible drinking in the country through a whole-of-society approach that involves a collaborative effort between the industry, its value chain, civil society, and the government.

A lack of robust regulatory enforcement has allowed the illicit alcohol market to thrive, which not only undermines legitimate businesses but also poses public health risks. This is compounded by the need for stricter enforcement of existing alcohol laws to ensure safer drinking habits and responsible trading practices. Strengthening partnerships with law enforcement and regulatory bodies will be critical in addressing these challenges.

DF-SA envisions a drinks industry that is valued not only for its economic contributions but also for its role in creating a prosperous, just, and safer South Africa. By unifying the industry and promoting responsible practices, DF-SA aims to ensure that the sector’s positive impacts are felt across all levels of society, securing long-term growth and stability for the industry.

[[relatedPurchasesItems-63]]

Conclusion:

Angela Russell and the leadership team at DF-SA are setting a powerful precedent for unity within South Africa's alcohol industry. Through their collaborative approach, DF-SA has addressed some of the industry's most pressing challenges, from curbing illicit trade to promoting responsible drinking and supporting socio-economic development. Looking ahead, DF-SA remains committed to driving progress, with a clear focus on scientific research, stakeholder engagement, and community well-being. Under Angela’s guidance, the Federation is poised to continue its mission of ensuring that the alcohol industry is not only a significant economic contributor but also a positive force for societal change in South Africa.

In conversation with Malvika Patel, Editor and VP, Beverage Trade Network

Also Read:

South Africa Wine Part One: Industry Growth and Black Power

South Africa Wine Part Two: Current Challenges Facing the Wine Industry

South Africa's highest-scoring Mooka Rum on Winning at the London Spirits Competition