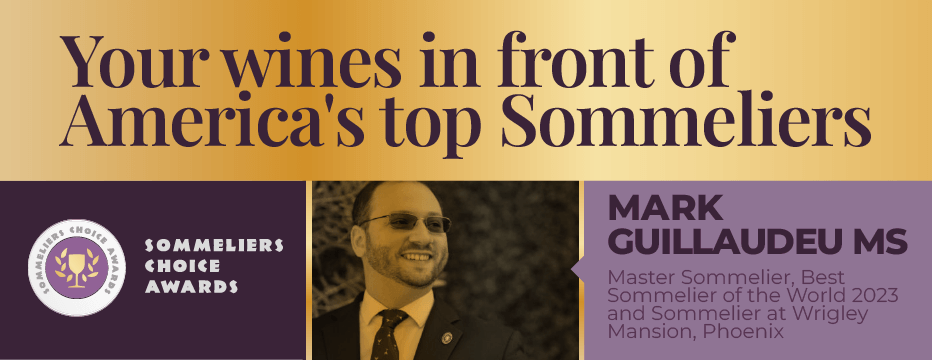

Sommeliers Choice Awards 2023 Winners

Research Reports on Beverages Equities

Stock-callers.com brings focus back on the Beverages industry, particularly the Brewers category, to see how some equities have fared over the last few trading sessions

Companies in this segment primarily produce alcoholic beverages made from malted barley and hops such as beer, malt liquor, and non-alcoholic beer. This industry excludes wine, brandy, cider, and distilled beverages such as vodka and rum. Up for evaluation today are: Ambev S.A. (NYSE: ABEV), Anheuser-Busch InBev S.A./N.V. (NYSE: BUD), Molson Coors Brewing Co. (NYSE: TAP), and Fomento Economico Mexicano S.A.B de C.V (NYSE: FMX).

Ambev

Sao Paulo, Brazil headquartered Ambev S.A.'s shares climbed 0.81%, finishing Thursday's trading session at $4.95. A total volume of 11.42 million shares was traded. Since the start of this year, the stock has advanced 10.99%. The Company's shares are trading below their 50-day moving average by 6.14%. Moreover, shares of Ambev, which through its subsidiaries, produces, distributes, and sells beer, draft beer, soft drinks, other non-alcoholic beverages, malt, and food in the Americas, have a Relative Strength Index (RSI) of 46.65.

Anheuser-Busch InBev

On Thursday, shares in Leuven, Belgium headquartered Anheuser-Busch InBev S.A./N.V. recorded a trading volume of 1.01 million shares, and ended the session 0.95% higher at $104.89. The stock has gained 0.08% in the last one month. The Company's shares are trading 2.99% below their 50-day moving average. Furthermore, shares of AB InBev, which engages in the production, distribution, and sale of beer, alcoholic beverages, and soft drinks worldwide, have an RSI of 50.83.

On December 21st, 2016, The Coca-Cola Co. and Anheuser-Busch InBev announced an agreement regarding the transition of AB InBev's 54.5% equity stake in Coca-Cola Beverages Africa (CCBA) for 3.15 billion USD, after customary adjustments. CCBA includes the countries of South Africa, Namibia, Kenya, Uganda, Tanzania, Ethiopia, Mozambique, Ghana, Mayotte and Comoros. In addition, both companies have reached an agreement in principle for Coca-Cola to acquire AB InBev's interest in bottling operations in Zambia, Zimbabwe, Botswana, Swaziland, Lesotho, El Salvador and Honduras for an undisclosed amount. The transactions are subject to the relevant regulatory and minority approvals and are expected to close by the end of 2017.

Molson Coors Brewing

Shares in Denver, Colorado headquartered Molson Coors Brewing Co. closed at $98.02, rising 1.09% from the last trading session. The stock recorded a trading volume of 624,625 shares. The Company's shares have advanced 6.15% on an YTD basis, and are trading 1.65% below their 200-day moving average. Additionally, shares of Molson Coors Brewing, which manufactures and sells beer and other beverage products, have an RSI of 48.64.

On November 18th, 2016, Molson Coors Brewing announced that Tracey Joubert, current Chief Financial Officer of the Company's US business, has been appointed as Molson Coors' new Chief Financial Officer, effective immediately.

On December 20th, 2016, research firm Stifel reiterated its 'Buy' rating on the Company's stock with a decrease of the target price from $117 a share to $113 a share.

Fomento Economico Mexicano

At the closing bell yesterday, shares in Monterrey, Mexico headquartered Fomento Economico Mexicano S.A.B de C.V ended 1.03% higher at $76.86 with a total trading volume of 315,045 shares. The stock is trading below its 50-day moving average by 8.26%. Shares of the Company, which through its subsidiaries, operates as a bottler of Coca-Cola trademark beverages and a chain of small-format stores, have an RSI of 38.68.

Stock Callers

Stock Callers (SC) produces regular sponsored and non-sponsored reports, articles, stock market blogs, and popular investment newsletters covering equities listed on NYSE and NASDAQ and micro-cap stocks. SC has two distinct and independent departments. One department produces non-sponsored analyst certified content generally in the form of press releases, articles and reports covering equities listed on NYSE and NASDAQ and the other produces sponsored content (in most cases not reviewed by a registered analyst), which typically consists of compensated investment newsletters, articles and reports covering listed stocks and micro-caps.

Source: PR Newswire