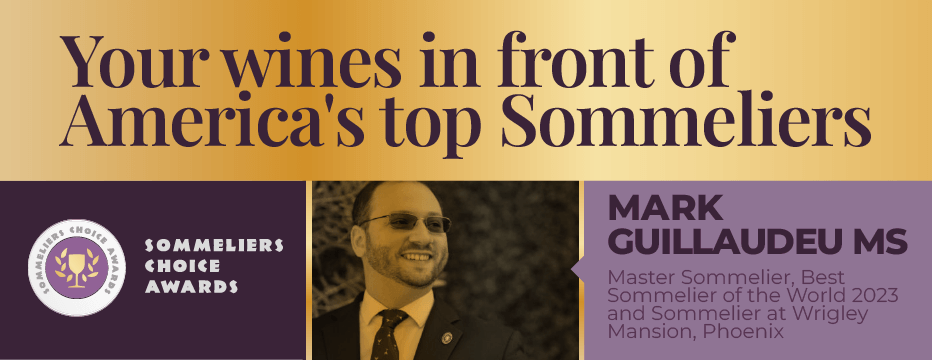

Sommeliers Choice Awards 2023 Winners

Coca-Cola Acquires Chinese Multigrain Drinks For $514M: Deal Strengthens Coke’s Strategy Of Diversification

American soft drinks major Coca-Cola has announced the purchase of a plant-based drinks business in China.

By Kalyan Kumar

American soft drinks major Coca-Cola has announced the purchase of a plant-based drinks business in China. Under the deal, Coke will pay US$400 million [$514 million] in cash to Xiamen Culiangwang Beverage Technology Company, based in Xiamen, Fujian province.

"The proposed acquisition is in line with Coca-Cola China's strategy to provide a diverse range of beverage products to Chinese consumers with plantbased protein drinks representing a growing beverage category in China," the U.S. beverage giant said in a statement, reports Reuters.

The Chinese company's top-selling products are green bean, red bean and walnut variants of plant-based protein drinks marketed under the brand name China Green Culiangwang. It is owned by Hong Kong-listed China Culiangwang Beverages Holdings.

Soaring Demand

The market for plant-based protein drinks is growing in China at the rate of 18 percent a year since 2008, according to a report by Mintel Group Ltd. Many Chinese are lactose intolerant and see protein drinks as healthier alternatives to milk. Milk safety is also a major issue in China especially after locally made melamine-contaminated milk powder killed many infants in 2008. The acquisition also marks Coca-Cola’s foray beyond carbonated beverages and bottled water into areas like coffee and energy drinks. However, in 2009, Coke had to beat a retreat when Chinese authorities blocked its plan to buy Huiyuan Juice.

So the deal marks Coke's first successful takeover in China after the Huiyuan debacle. Post-takeover, China Culiangwang will focus on developing its consumer products business, the company said in a stock exchange statement. The deal will now go to the approval of Chinese antitrust authorities.

Paying A Premium

In the China deal, Coke is paying a premium to Culiangwang's market value of US$230 million. For one thing Xiamen Culiangwang deal brings a slew of benefits to Coke. On the one hand, it helps Coca-Cola capitalise on the surging popularity of plant-based protein drinks as consumers are moving away from milk. Secondly, it gives the American giant an opportunity to reinvigorate overseas sales after a slowdown.

Cokes’ earnings had U.S. sales at the top with no solid contribution from international sales. For Coke, the Chinese market is not a big growth market as Coca-Cola brand beverage had a growth of only 3 percent in the last quarter. It is expected that Xiamen Culiangwang deal would add more cheer to Coke as it will enhance its appeal to the local consumers.

(For feedback/comments, contact the writer at kalyanaussie@gmail.com)

Source | International Business Times.