Sommeliers Choice Awards 2023 Winners

Beer Giants Cultivate Their Crafty Side

AB InBev bought Oregon-based 10 Barrel Brewing Co. last month and earlier this year acquired New York-based Blue Point Brewing Co.

Photo Source: WSJ

When Anheuser-Busch InBev NV’s board held its annual U.S. meeting this year, it met at a small brewery in Chicago. There, Chief Executive Carlos Brito and directors from the world’s largest brewer peeled and sliced oranges for wine barrels filled with beer to make a farmhouse ale.

The reason: Growth in the U.S. isn’t in mass-produced brands, but small labels like Chicago-based Goose Island, which makes labor-intensive beer like the orange-infused Sofie ale and was acquired by AB InBev in 2011.

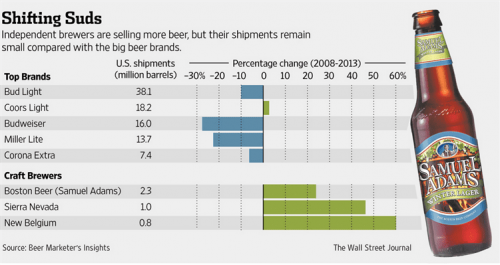

Four of the five largest U.S. beer brands, including AB InBev’s Budweiser and Bud Light, posted volume declines last year. There are more than 3,000 small “craft” brewers in the U.S., twice as many as half a decade ago, and their combined shipments have grown by a double-digit percentage five straight years, according to the Brewers Association, which represents small brewers.

When it comes to what Americans eat and drink, small brands are big. From beer to burgers to yogurt, consumers in recent years have shifted their affections from the established names that long dominated the industry to upstarts that offer more inventive products, greater cachet, or the perception that they are healthier or more natural than the products of giant conglomerates.

The shifts are buffeting food and beverage companies that built businesses on national advertising and massive production scale. McDonald’s Corp. ’s sales are suffering at the hands of fast-growing smaller chains like Chipotle Mexican Grill Inc. and Five Guys Burgers & Fries. Yogurt maker Chobani LLC has gobbled market share from General Mills Inc. ’s Yoplait and Danone SA ’s Dannon.

View Full Story At Source (Wall Street Journal)